Recently RBI made it mandatory to provide one free annual credit

report to individuals. Now based on this, you can check CIBIL credit

score online for free. This I think the best move.

Even

now other credit rating agencies like Equifax or Experian also started

to provide this facility. This free facility will be available from 1st

Jan, 2017.

What is the history and full form CIBIL?

CIBIL

is the Credit Information Company (CIC) founded in August 2000. Along

with CIBIL, there are few more like Equifax or Experian. The full form

(or long form) of CIBIL is “Credit Information Bureau of India Limited”.

This is India’s first credit information company.

It collects and

maintains records of an individual’s payments related to loans and

credit cards. These records are submitted to CIBIL by banks and other

financial institutions, on a monthly basis. This information is then

used to create Credit Information Reports (CIR) and credit scores which

are provided to credit institutions in order to help evaluate and

approve loan applications. CIBIL was created to play a critical role in

India’s financial system, helping loan providers manage their business.

Such

information is later used to create Credit Information Reports (CIR) or

credit scores which are provided to credit institutions and

individuals. This will helps to evaluate or approve the loan of

individuals.

What is the meaning of Credit Score or Rating?

A

credit score is a number that shows an individual’s creditworthiness.

Usually, banks or lenders use this credit score to evaluate the

probability of whether an individual repay his debts or not.

Hence, this is one of the utmost criteria that to keep higher credit score. It contains below reports.

- It contains your past and present credit history.

- Today Banks and Financial Institutes sanction loan based on your credit history. So a good score will help you to get loans sanctioned easily.

- You can follow the discipline in future by analyzing the current score.

- It helps you to understand your credit worthiness.

- It will automatically understand you whether to go ahead for fresh credit or not.

- Usually, 750 to 800+ range of score is considered as a good score.

What type of issues affects your Credit Score?

- Irregular Loan Re-Payment.

- Cheque bounce in past.

- If you default your credit card bill.

- The Higher number of unsecured loans such as personal loan and credit cards.

- Higher the rate of application for unsecured loans.

- If you are defaulter for your friend’s loan for whom you are acted as guarantor.

- Using your credit card limit fully.

How to improve your score?

- Never default your EMI or Credit card bills. Pay them regularly without fail and within a stipulated period.

- Don’t try to overburden yourself with the number of loans. If your credit score is good then banks will usually be ready to sanction more loan than what you actually asked for. But maintain strict limit based on your requirement.

- Avoid having multiple unsecured loans and credit cards on a single name.

- Always collect “No due Certificate” from your banker after closing the loan.

- Keep some distance while applying for fresh loans, usually a 6-12 months gap.

- Never be a guarantor to your friend or relatives. Because it will automatically affect your scoring if they default.

- Always try to utilize the lesser than specified limit on your credit cards.

- Never try to run away from your loans. Try to settle them as soon as possible in an amicable way with your banker.

How to check CIBIL credit score online for free?

Now

you completely understood the importance of credit score. Also, you may

now be feeling happy that RBI made it mandatory to all Credit

Information Companies to provide one credit report a year at free of

cost.

Below I will explain you the procedure of how to check CIBIL credit score online for free.

# Visit Free CIBIL Report Score Page. This homepage looks like below.

In this page, at the lower side, you will find the line “Click here to try your Free Annual CIBIL Score & Report“. Click on this.

#

The new window will open where you have to provide your Email Address,

Date of Birth, Gender and also PAN card number. Then click on Submit tab

after entering the Captcha and also clicking on to accept the terms and

conditions. The screen looks like below.

#

Once click on Submit tab, the next screen looks like below. Here, you

have to fill your full name, identify proof you submitted (PAN number)

and provide your address and contact details as below.

# Once you fill above data and click on Submit tab, then the pop-up window will open. Here, you have to click on “No, thanks”.

# A congratulation message will pop-up as below and requesting you to login to myCIBIL.

# Now you have to go to myCIBIL login page.

# Once you log in, then you will get the below home screen where you will notice your credit score as below.

#

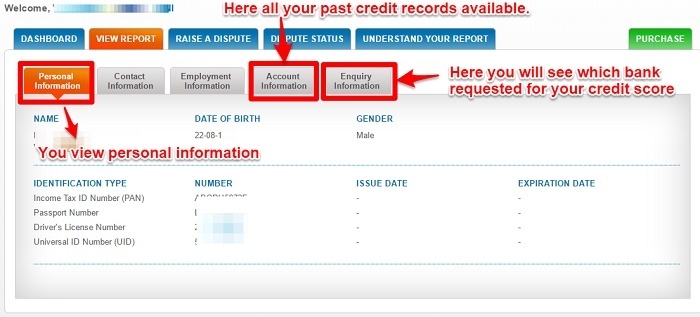

Under View Report you are able to see personal information, contact

information, Account information (existing and past credit history) and

Enquiry information (list of banks who asked for your credit report).

The screen looks like below.

This

is how you can check CIBIL credit score online for free. Hope this

information will be helpful to you all in understanding and analyzing

your credit score in a better way.

Which is the best credit score?

750-900-Excellent

Score and indicates the healthy financial life of an individual in

repaying his credit. You will get loans at competitive price

700-750-Fiar enough but can get loan will less competitive price.

550-700-Low score and indicates delays or irregularities in repayments in the past.

300-500-Lowest score and indicates irregular payment history.

0 comments:

Post a Comment